Markets evolve. Most strategies don’t survive.

Static strategies decay. Evolution adapts.

Evolutionary selection — in real time

Technology

Trading Model Evolution

A Trading Model consists of an entry logic generator, a position manager and a regime filter. Each strategy is a unique combination of these components, with different parameters (Genes)

Live Backtesting

Every minute, our system runs thousands of simulations on live market data. It tests each Trading Model against the current market conditions, evaluating their performance in real-time.

Natural Selection

Only the most consistent and profitable trading strategies ‘survive’ and produce offsprings. Just like in nature.

Adaptation to Market Changes

The best models are constantly evolving to adapt to changing market conditions. They learn from their past performance and adjust accordingly.

Built for regimes, not narratives

Why darwintIQ

Always Up to Date

Our engine constantly evolves by analyzing the latest market data and adapt to changing markets — so you're never trading yesterday’s logic.

Mehr Details →Connect with the API

Connect the analysis results to your own systems. Build automation. Connect it with MetaTrader. Automate your trades, analyze sentiment, or build your own trading strategies using our API. Be creative!

Mehr Details →No Overfitting

Models are tested in a sliding time window. This ensures it adapts to real market conditions, not just past data.

Mehr Details →No Hype — Just Data

We don’t promise entry logic that ‘always wins’. We show you which ones are actually performing now — backed by hard data. If there's no entry logic, we say so. If there is, we show you the data behind it. No hype, just results.

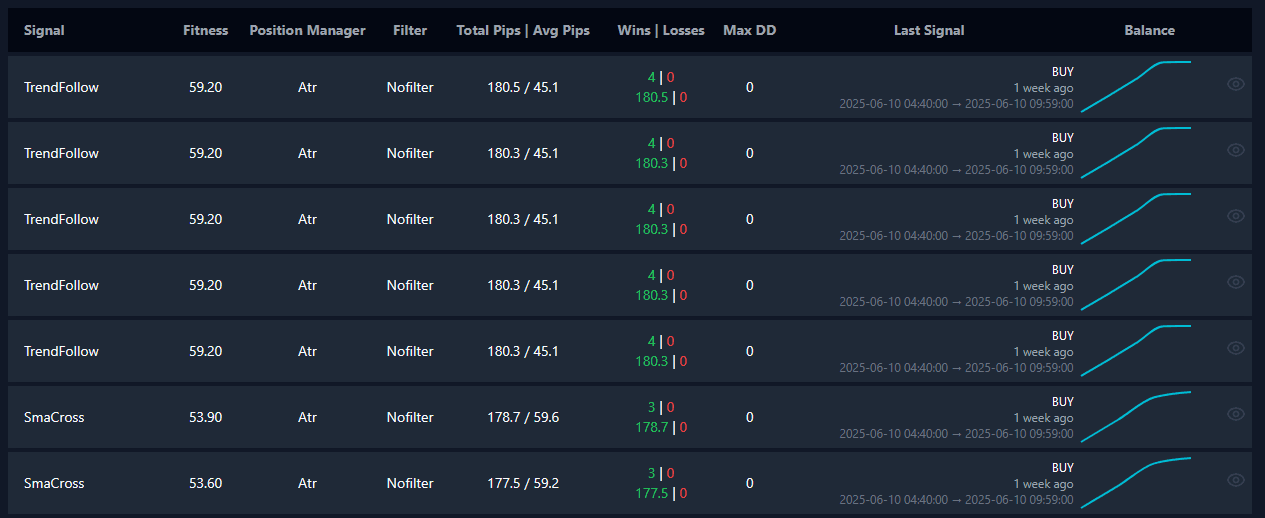

Mehr Details →Live Trading Model Fitness Tracking

Live Intelligence

Live Model Score Card

BollingerBands

The Bollinger Bands strategy generates trading signals based on price movements relative to the Bollinger Bands, calculated over a 22-period with a standard deviation multiplier of 0.10. The middle band is a moving average (type: 1), and signals consider a recent middle-band crossover within 174 periods, using the High price.

- A BUY (Long) signal is generated when a candle opens and closes below the lower Bollinger Band, followed by a recent middle-band crossover from above within 174 periods.

- A SELL (Short) signal is generated when a candle opens and closes above the upper Bollinger Band, followed by a recent middle-band crossover from below within 174 periods.